FEMA Flood Insurance Rate Maps Update for O‘ahu

Final Flood Insurance Rate Maps (FIRMs) Released

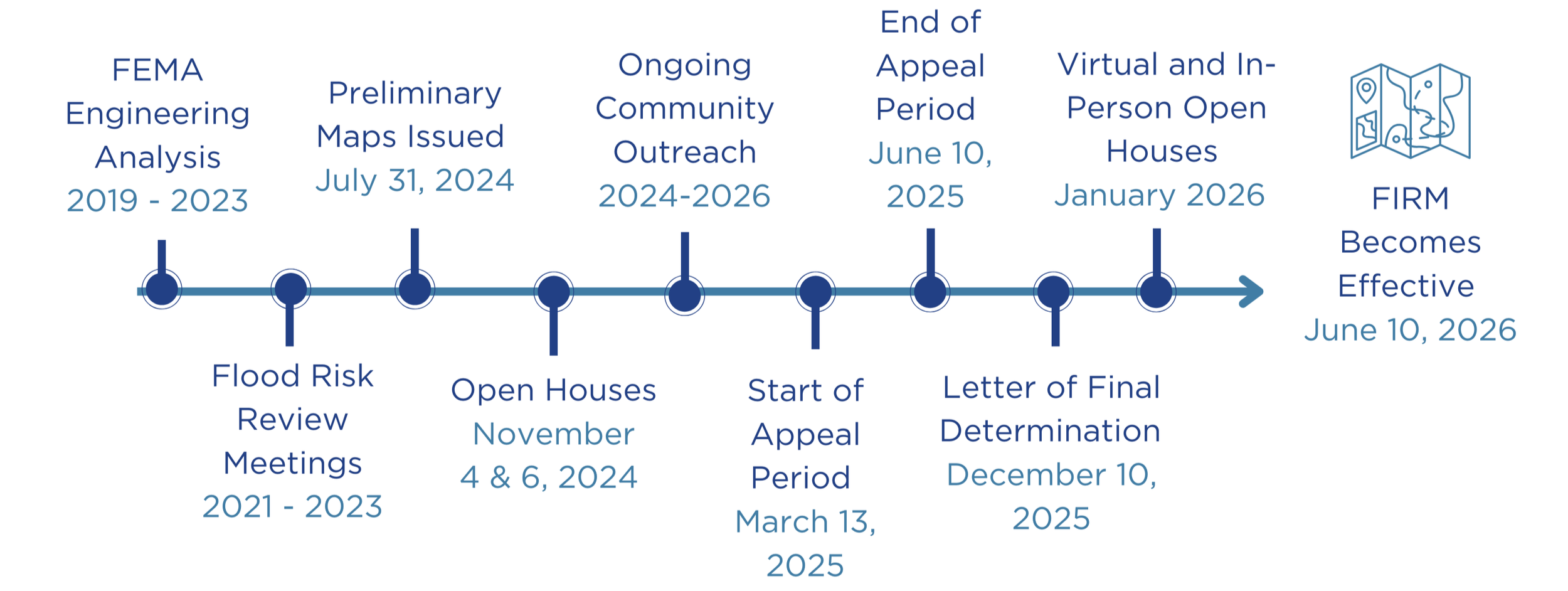

The Federal Emergency Management Agency (FEMA) provides communities with Flood Insurance Rate Maps (FIRMs) to determine flood zones and high-risk flood areas. From 2019-2024, FEMA studied flood risk along numerous streams across Oʻahu, many of which had not been studied before. Using the study’s findings, FEMA released an update to FIRMs on Oʻahu.

As part of the FIRMs update process, the preliminary maps underwent a 90-day public appeal and comment period from March 13, 2025, to June 10, 2025. During this period, the public was able to appeal changes to their property’s flood risk designation and provide comments on the maps. FEMA then reviewed and resolved all appeals and comments, issuing the finalized FIRMs and the Letter of Final Determination on December 10, 2025. The letter states the updated FIRMs will become effective on June 10, 2026, along with all regulatory and flood insurance requirements.

The community is encouraged to review the preliminary FIRMs to determine if their flood risk has changed before the effective date. Property owners with a federally-backed loan or mortgage who are newly mapped in the Special Flood Hazard Area may be required by their lender to obtain flood insurance, and should familiarize themselves with ROH Chapter 21A. Special Flood Hazard Areas (Zones A, AE, AEF, AH, AO, V and VE) are regulated by the City and are considered to have special flood or flood-related erosion hazard risk by FEMA.

Use the button below to find your property on the flood map. For instructions on how to use the viewer, click here. For more information on map changes and flood insurance, see this brochure from FEMA.

On June 10, 2026, the updated FIRMs will become effective, along with all regulatory and flood insurance requirements. Now is the time to shop around for the best flood insurance coverage for your property. If you are required to have coverage and have not purchased a policy within 45 days after the effective date, your lender may force-place a policy. This means you would have no control over the policy cost or coverage terms. Talk to your insurance provider now to determine if you are eligible for a pre-FIRM or newly mapped discount and the best time to purchase a policy. Even if your property does not require flood insurance, it’s still recommended to talk with an insurance agent since every property has flood risk.

What Actions Can You Take?

Watch the virtual open house recording from January 15, 2026 to learn more (see below).

Re-evaluate what financial protections you have in place for your home and business and talk to your insurance agent about flood insurance options.

Review additional steps you can take to make your property more flood resistant and visit the State Insurance Division Consumer Resources page for more information.

If you believe the new flood hazard determinations are technically incorrect, scroll down to learn more about submitting a Letter of Map Amendment or Letter of Map Revision to FEMA.

Find resources in Español (Spanish), Tagalog, Tiếng Việt (Vietnamese), 한국인 (Korean), 中國人 (Chinese), and 日本語 (Japanese)

Get a Discount on Flood Insurance Premiums

The City participates in FEMA’s National Flood Insurance Program (NFIP) so residents are eligible to purchase flood insurance as financial protection against flood losses. After a temporary lapse, the NFIP was reauthorized on November 12, 2025, and authorization has been extended through September 30, 2026. Any claims for covered losses that occurred during the lapse period can now be processed and paid. Private flood insurance is not affected by a lapse in the NFIP.

The City also voluntarily participates in FEMA’s NFIP Community Rating System program, which provides a 10% discount on flood insurance premiums for NFIP policyholders on Oʻahu based on actions the City has taken to reduce flood risk. Talk to your insurance agent about flood insurance options. If you need flood insurance and aren’t sure where to start, use the “Insure My Property“ button to view a list of NFIP providers or get an NFIP policy quote and learn more about protecting your home and belongings.

FEMA has announced plans allowing NFIP policyholders to pay their premiums in monthly installments rather than a single annual lump sum. This new rule is effective December 31, 2024, and the monthly payment option will be available for new or renewed policies starting October 2025. Traditionally, NFIP premiums have been due all at once each year – this new option reflects a shift in FEMA’s approach to be more flexible and reduce the financial strain a large annual bill can create. Click here for more details on the installment plan.

If you aren’t sure where to get started, click the “Get a Quote” button to check out FEMA’s Direct-to-Consumer online quoting tool. This tool allows homeowners and renters to create an NFIP flood insurance quote based on your property’s address and simple characteristics of your home. The tool uses the same risk rating engine insurance agents use, and allows you to add in flood risk mitigation measures to see what discounts these measures could provide to your premium. These quotes can be shared with your current or future insurance agent. Note that your quote will not reflect any pre-FIRM or newly mapped discounts until after the effective date (June 10, 2026). You should always talk with an agent to confirm you have the best coverage for you and that the input information used to obtain your quote is correct.

Public Outreach

To help the community better understand the FIRM update and its implications, FEMA, the City and DLNR will be hosted a virtual open house on January 15, 2026, to discuss the FIRM update, insurance requirements and what happens once the FIRMs become final. You can view a recording of the 2026 virtual open house and find the presentation slides by clicking on the buttons below or attend an in-person event on January 21, 2026:

In-person open houses were also held January 21, 2026 at the Kāneʻohe Community & Senior Center and ʻAiea Public Library. Additional outreach events will be posted here throughout the update process. Updates will also be posted via social media and newsletter.

Two open houses were also held on November 4 and 6, 2024, where FEMA, City, and DLNR representatives provided information on the FIRM update process, flood risks, potential changes to flood insurance requirements, and steps residents can take to protect their property from flooding. You can view a recording of the 2024 virtual open house and the presentation slides to learn more about the preliminary notice.

Information Stations

The City is hosting Information Stations in libraries of the most heavily impacted areas of the island. The Information Stations will have FEMA materials in multiple languages with additional information about flood insurance.

Need flood risk resources in a different language? Find resources here!

ʻĀina Haina Public Library — 5246 Kalanianaʻole Hwy, Honolulu, HI 96821

Waiʻanae Public Library — 85-625 Farrington Hwy, Waianae, HI 96792

Liliha Public Library — 1515 Liliha St, Honolulu, HI 96817

Hawaii State Public Library — 1325 Kalihi St, Honolulu, HI 96819

Kāneʻohe Public Library — 46-056 Kamehameha Hwy, Kaneohe, HI 96744

Kaimukī Public Library — 1041 Koko Head Ave, Honolulu, HI 96816

Pearl City Public Library — 1138 Waimano Home Rd, Pearl City, HI 96782

Waipahu Public Library — 94-275 Mokuola St, Waipahu, HI 96797

Mililani Public Library — 95-450 Makaimoimo St, Mililani, HI 96789

FIRM Update Timeline

Letter of Map Amendment and Letter of Map Revision

If you believe the map updates are technically incorrect for an area and you were unable to submit an appeal during the appeal process, residents can work with FEMA to potentially change their FIRM designation at any time through processes called Letter of Map Amendment (LOMA) or Letter of Map Revision (LOMR). While the LOMA/LOMR is being reviewed, the current FIRM designation will be effective. If your building is identified as being in a high risk flood zone, but the FIRM shows the building is outside of that zone, the LOMA (Out as Shown) process may assist a homeowner in working with their lender to remove the mandatory flood insurance purchase requirement.

Learn More About FIRMS

Flooding occurs naturally and can happen almost anywhere at anytime. According to a 2024 City survey, one in three Oʻahu residents have first- or second-hand experience with flooding. Between 2018 and 2023, Oʻahu residents participating in FEMA’s NFIP filed over 360 claims totaling more than $27.4 million in loss and damages.

FIRMs show how likely it is for an area to flood, and apply a flood zone designation to a location based on a variety of factors that can influence their flooding risk. The FIRMs and the associated Flood Insurance Study report are the basis for Oʻahu’s floodplain management. Below are descriptions of the flood zones most commonly found on Oʻahu.

Special Flood Hazard Areas (Zones A, AE, AEF, AH, AO, V, and VE): areas regulated by the City and considered to have special flood or flood-related erosion hazard risk by FEMA

Flood Zone X: areas not regulated by the City and considered to have minimal flood hazard risk by FEMA

Flood Zone D: areas not regulated by the City and considered to have an undetermined flood hazard risk by FEMA

While some areas have lower or undetermined risk, there is no such thing as a “no-risk” zone. Additionally, FIRMs may not tell the full story of flood risk. They do not include future impacts from climate change and may not reflect current conditions as communities grow and land use changes.

Contact

If you have any additional questions or concerns, please contact the FEMA Mapping and Insurance exchange, or FMIX, via FEMA-FMIX@fema.dhs.gov, live chat, or at 1-877-336-2627 (2:00 am to 1:00 pm HST). Self-service options are 24 hours a day, 7 days a week.

Frequently Asked Questions

-

FEMA works with communities across the country to identify flood hazards and promote ways to reduce the impact of those risks and other hazards. The preliminary flood map is a version of the FIRM circulated for community review and comment before it becomes effective.

FIRMs are official flood maps issued by FEMA showing a community’s flood zones with an applied risk designation based on a variety of factors. High-hazard flood zones, known as Special Flood Hazard Areas (SFHA), show where there’s a 1% annual chance of flooding. While some areas have lower or undetermined risk, there is no such thing as a “no-risk” zone.

FIRMs are used for floodplain management in the City’s Revised Ordinances of Honolulu (ROH) Chapter 21A, by financial lenders to determine the level of risk a property may face, and if flood insurance is required for a property.

-

Flood risks change over time. Changes can be due to new land uses, community development, or natural forces (changing weather, terrain changes, wildfires, etc.). FEMA works with local communities and uses the latest technology to update and issue flood maps nationwide. Every year, thousands of homeowners and renters across the U.S. experience devastating flood events even though they may not live near a body of water. On Oʻahu, extreme flooding has impacted communities like Waimānalo, ʻĀina Haina, Hawaiʻi Kai, and North Shore in recent years.

The City is working with FEMA to understand our flood risks and how they may have changed over time. Much of the mapping being revised was produced over 25 years ago. Today’s flood maps are clearer in the risks they show. This aids our community members, property owners, and other stakeholders in taking steps to address flood risks to protect our families, homes and businesses.

-

As the City works with FEMA to update our flood maps, you may find the risk of flooding around your property has changed. This could have impacts on building and flood insurance requirements.

Now is a good time to re-evaluate what protections you have in place for your home or business. In addition to taking steps to make your property more flood resistant, talk to an insurance agent about flood insurance options based on any flooding-related changes that could potentially be putting your property more at risk.

Properties newly mapped into a Special Flood Hazard Area: If your property has a federally-backed mortgage, you will be notified by your lender once the FIRMS are effective if you are subject to the mandatory flood insurance purchase requirements. . The City and County participate in the NFIP Community Rating System making residents eligible for a 10% reduction on annual full risk rated NFIP policy premiums. You may also qualify for the NFIP's one-time Newly Mapped Discount. Check with your insurance agent to see if you qualify. These discounts are not available for non-NFIP private flood insurance policies.

-

Properties newly mapped into a Special Flood Hazard Area: If your property has a federally-backed mortgage, you will be notified by your lender once the FIRMS are effective if you are subject to the mandatory flood insurance purchase requirements. . The City and County participate in the NFIP Community Rating System making residents eligible for a 10% reduction on annual full risk rated NFIP policy premiums. You may also qualify for the NFIP's one-time Newly Mapped Discount. Check with your insurance agent to see if you qualify. These discounts are not available for non-NFIP private flood insurance policies.

Properties newly mapped out of a Special Flood Hazard Area into a low to moderate risk flood zone: If your structure has a federally-backed loan, your lender, at their discretion, may remove the mandatory purchase requirement. Talk to your insurance agent about your changed flood risk and insurance options. Consider protecting yourself with flood insurance. NFIP insurance premiums are determined based on your property’s unique flood risk, regardless of zone. Flooding can happen anywhere on O'ahu and having flood insurance enables folks to recover faster.

-

No, flood damage is not typically covered by standard homeowner’s or renter’s insurance policies. Flood insurance is available for homeowners and renters through the NFIP or private insurance providers. Homeowners can obtain a flood insurance policy that includes building and contents coverage. Renters can obtain a flood insurance policy to cover contents. NFIP coverage for individual condominium units and condo associations is also available. Talk to your local insurance agent for more information.

-

Yes, if you believe your property has been incorrectly designated as a high-risk area, FEMA has a process allowing property owners to appeal the designation of their property through either a Letter of Map Amendment (LOMA) or Letter of Map Revision (LOMR). Note that while the LOMA/LOMR is being reviewed, the current FIRM designation will be effective. To learn more about these processes, visit FEMA’s LOMA/LOMR information page.

-

You should wait until the updated FIRMs become effective to buy or renew your policy. Once the updated FIRM becomes effective on June 10, 2026 your property may qualify for a Newly Mapped Discount. Eligibility for the Newly Mapped Discount is as follows:

Your property was previously mapped in a Zone B, C, D, or X and is now being mapped into a SFHA (Zones A, AE, AEF, AH, AO, V and VE).

You secure an insurance policy within 12 months of June 10, 2026; or you apply for the policy within 45 days of initial lender notification, if the notification occurred within 24 months of the effective FIRM revision date.

Speak with your flood insurance agent — they can track the effective date and ensure you meet timing rules.